Services & Prices

Tax Returns:

- Standard: $135+

- Backpacker (417/462 visa): $165+

- Sole-trader: $185-235+

- Partnership: $300+

Extras:

- Logbook claim: $25+

- Rental property: $110+(1)

- Sale of property (inc. report): $300+(2)

- Other capital gains/ crypto(2)

(1)Per property, not per return with rental income.

(2)Subject to time/ complexity involved.

Call-out Fee:

- Perth northern suburbs: $0

- Perth outer suburbs (existing clients only): TBA

Payment Methods:

We generally accept cash or bank transfer.

*Fee from refund service: $30

Free for Existing Clients:

- Copy of previous returns

- Simple amendments

- Non-lodgement advice

- General tax queries, etc.

Price Comparison:

Not only are we able to provide a superior service, but you will find our prices to be very competitive!

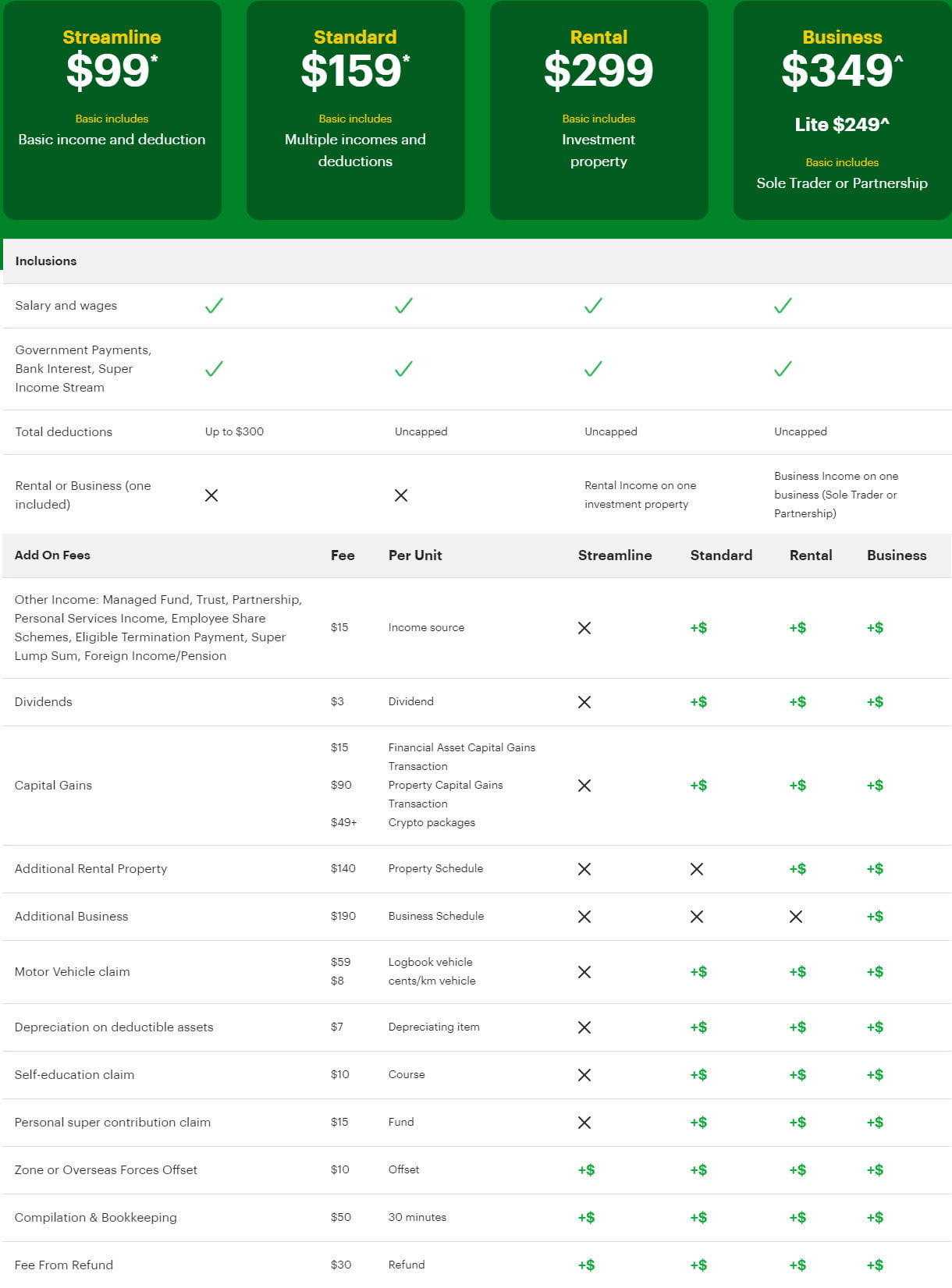

H&R Block (2023):

Key Differences:

- They have a LOT more additional charges

- Couple with a joint rental? We start at $350 whereas they start at $598

- Sole trader over 10k income? We start at $175 whereas they start at $349